4Sale’s Property Year in Review 2025

Kuwait’s property market operated in a more complex environment in 2025, reflecting a period of adjustment across demand and activity levels. Market performance was shaped by broader economic conditions, regulatory updates, and shifting population dynamics.

During the year, the government introduced measures aimed at improving market clarity and supporting long-term investment. These included expanded property ownership rights for licensed investment entities and a new decree clarifying real estate ownership rules for companies and funds with foreign participation.

4Sale’s 2025 Property in Review presents key insights into Kuwait’s real estate market, including listings distribution by governorate and district, year-over-year growth and decline in listings by governorate, and the distribution of listings across property categories.

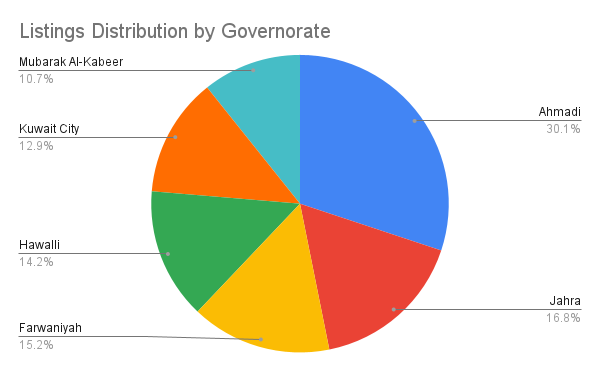

Listings Distribution by Governorate

Key takeaways

- Ahmadi leads listings with 30.1%, reflecting its wide geographic coverage and diverse property mix, ranging from long-established residential areas to newer developments and oil-sector–adjacent housing zones.

- Jahra follows with 16.8%, driven by larger plot availability, lower entry prices, and steady demand from families seeking space outside central urban areas.

- Farwaniyah accounts for 15.2% of listings, supported by high population density, strong rental activity, and consistent demand for affordable residential units near commercial and employment hubs.

- Hawalli represents 14.2%, sustained by its central location, older apartment stock, and continued demand from renters seeking proximity to schools, services, and main roads.

- Kuwait City contributes 12.9% of listings, reflecting limited residential supply but steady activity in apartments, mixed-use buildings, and investment properties.

- Mubarak Al-Kabeer records 10.7%, driven by newer residential areas, expanding infrastructure, and growing interest from Kuwaiti families moving toward southern suburbs.

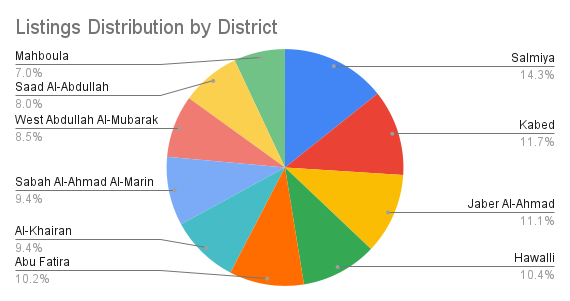

Top 10 Areas by Listings Share

Key takeaways

- Salmiya leads district-level listings with 14.3%, driven by its dense residential stock, proximity to commercial areas, and strong rental demand from families and expatriates.

- Kabed follows with 11.7%, reflecting high supply of larger plots, warehouses, and farm-adjacent properties that appeal to buyers seeking space outside urban density.

- Jaber Al-Ahmad accounts for 11.1% of listings, supported by its planned residential layout, government housing projects, and growing appeal among Kuwaiti families.

- Hawalli represents 10.4%, sustained by its central location, older apartment buildings, and consistent demand for affordable rentals close to schools and services.

- Abu Fatira contributes 10.2%, reflecting demand for newer residential developments and proximity to southern growth areas.

- Al-Khairan and Sabah Al-Ahmad Al-Marin each hold 9.4%, driven by interest in waterfront properties, chalets, and seasonal or leisure-oriented housing.

- West Abdullah Al-Mubarak and Saad Al-Abdullah show notable activity linked to newer residential allocations and expanding infrastructure.

- Mahboula records 7.0% of listings, supported by high-density apartment supply and steady rental demand tied to nearby employment zones.

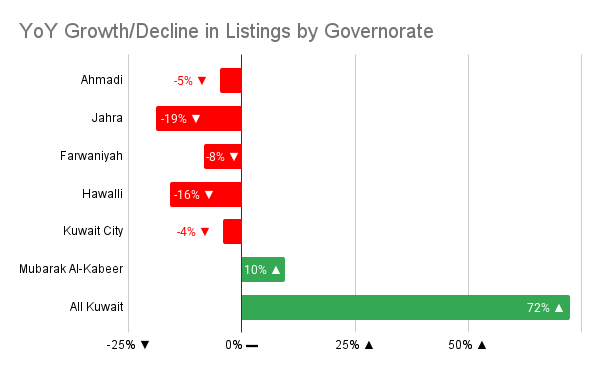

YoY Growth/Decline in Listings by Governorate

Note: Listings classified under All Kuwait are not tied to a specific governorate and typically appear across multiple locations.

Key takeaways

- Mubarak Al-Kabeer is the only governorate recording positive growth at 10%, supported by new residential developments and increased listing activity in southern areas.

- Jahra records the largest decline at 19%, reflecting slower listing activity in outer residential zones.

- Hawalli declines by 16%, influenced by aging apartment stock and softer demand in older central areas.

- Farwaniyah shows an 8% decline, pointing to more cautious listing behavior in high-density residential segments.

- Ahmadi and Kuwait City post smaller declines of 5% and 4%, indicating relatively stable activity despite broader market adjustments.

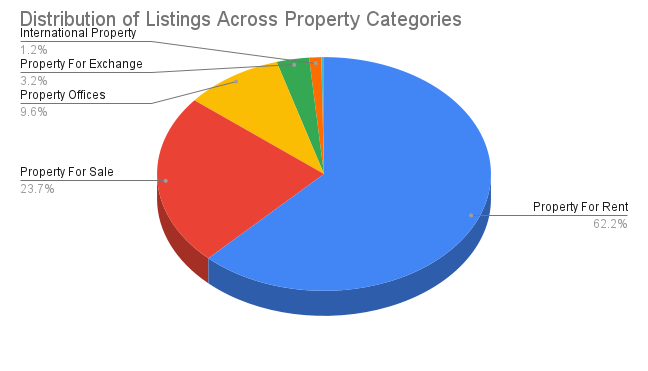

Property Listings Distribution by Category

Key takeaways

- Property for Rent is the dominant category, making up around 62% of total listings — clearly the largest segment and the core driver of user activity.

- Properties for sale account for 23.7% of listings, indicating steady ownership interest, particularly among Kuwaitis, but with buyers taking longer decision cycles.

- Property Offices account for around 10%, indicating a smaller yet steady stream of commercial and office-related property activity.

- Property for Exchange contributes roughly 3.2%, reflecting a niche user segment but one that consistently appears in the distribution.

- International property listings stand at 1.2%, reflecting niche interest mainly from local investors exploring diversification outside Kuwait.

- Property Services remains the smallest segment, contributing less than 1% of overall listings.

Final Thoughts: The Future of the Property Market in Kuwait

Kuwait’s property market in 2025 reflects a period of adjustment rather than contraction. Listing activity varies by location and category, but overall demand remains present, with users on 4Sale becoming more selective, value-driven, and location-focused.

Rental properties continue to dominate activity, underscoring the market’s preference for flexibility amid changing conditions. Ownership interest remains steady, particularly in established residential areas, though buyers are taking longer decision cycles and showing greater sensitivity to pricing and readiness.

Governorate and district-level trends highlight a shift toward newer residential areas and southern developments, while older and high-density zones experience softer listing growth. At the same time, regulatory updates aimed at improving market clarity support long-term confidence without driving short-term volatility.